Demystifying Bank Card Types: A Comprehensive Guide to Digital Wallets and their Compatibility

Digital wallets have changed how we handle money, quickly becoming a key part of everyday spending. It’s important for financial services to know how different types of secured credit cards, bank cards, ATM cards, and other cards work with these wallets.

Understanding this helps them maximize the use of eWallets, ensuring they provide consumers with varying transaction options that are easy, safe, and smooth.

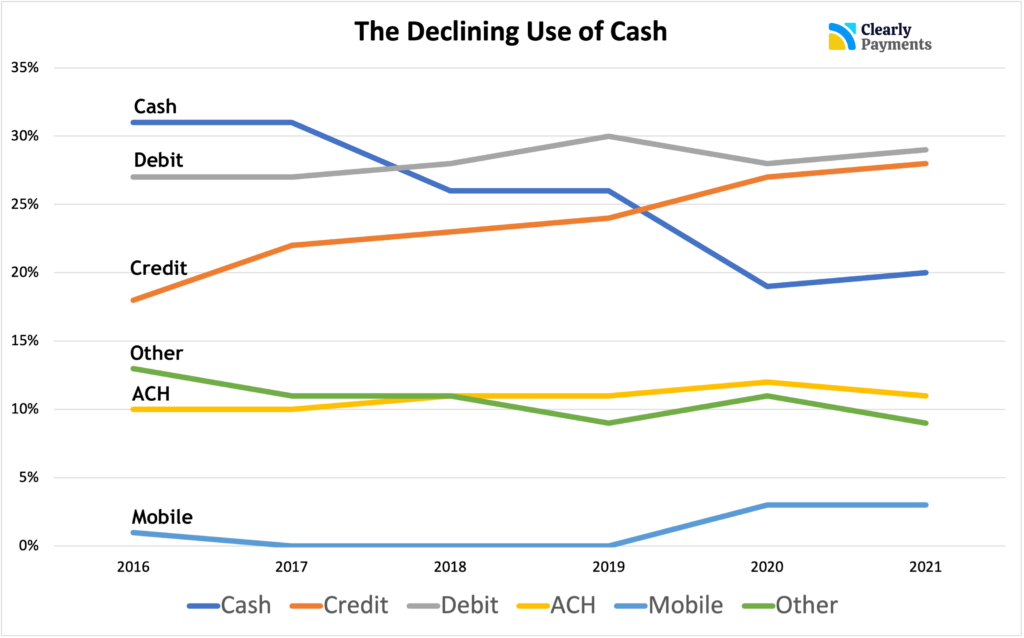

Digital wallet adoption is becoming increasingly popular (image source).

Table of contents

Understanding digital wallets

A digital wallet is an app that stores credit and debit card details on a mobile device or online service, allowing users to make online transactions.

Such wallets securely encrypt the user's payment data, providing a virtual substitute for the physical card.

To use a digital wallet, the user adds their credit/debit card details to the app. The wallet uses technologies like Near Field Communication (NFC) to facilitate transactions.

When making a purchase, the user authorizes the payment through the eWallet, which communicates with the payment terminal to complete the transaction.

Types of digital wallets

There are three broad categories of digital wallets.

Mobile wallets are what we described above–apps installed on smartphones, offering convenience for on-the-go transactions.

There are also eWallets available on personal computers or laptops, which are primarily used for internet purchases and e-commerce. They provide a secure environment for storing payment details and are ideal for users who prefer conducting financial activities on larger screens.

Cloud-based digital wallets are accessible over the internet from any device and offer the greatest flexibility. They store user information on remote servers, allowing access from multiple devices, be it a phone, tablet, or computer.

Your physical card information translates to a secure virtual card you can use online or through the associated mobile app. The same restrictions apply, including your credit limit, APR, etc. If your card is a debit card, you may also be subject to the same spending limits within a period of time (e.g., $500 per day) or location alerts unless you speak with your bank to have the limitations relaxed or removed.

Benefits of digital wallets

The benefits of eWallets are numerous. They:

- Allow you to track your spending, especially at times like Christmas.

- Allow the integration of loyalty and reward programs and gift cards.

- Offer enhanced security through encryption and biometric locks.

- Streamline online and in-store purchases.

- Reduce the need to carry multiple cards.

Digital wallets not only revolutionize online transactions but also play a crucial role in modern recruitment processes. As businesses increasingly embrace digital solutions, candidates often encounter seamless and secure payment experiences when engaging in recruitment-related activities, such as submitting application fees or attending virtual interviews.

Integrating eWallets into recruitment platforms ensures a convenient and secure financial interaction between applicants and employers, ultimately enhancing the overall efficiency and user experience in the hiring process.

How do digital wallets and bank cards interact?

When a user adds a bank card to their digital wallet, the card's details are encrypted and stored on their device or secure servers. This process often involves tokenization, where the actual card numbers are replaced with unique tokens for transactions, enhancing security.

During a transaction, the eWallet communicates with the payment terminal for contactless payments or secure internet connections for online purchases. The wallet then transmits the tokenized card information and authorizes the payment upon user authentication (which may include PINs, fingerprints, or facial recognition).

This system bypasses the need to present a physical card.

Exploring digital wallet compatibility with major card networks

Usually, all the ewallets are compatible with major card issuers such as:

- MasterCard debit and credit cards (ATM cards)

- Most cards with EMV chip and pin

- Mastercard maestro

- American Express

- Contactless cards

- Debit MasterCard

- Prepaid cards

There's a high chance nearly anyone who has a debit or credit card can add it to their digital wallet.

Acceptance can vary. For example, the adoption of American Express may hinge on different merchant agreements and fee structures.

This said, eWallets typically negotiate with these major networks to enable secure, tokenized transactions, ensuring that card details are safely encrypted. Furthermore, these networks often collaborate with digital wallet providers to offer additional perks, like rewards points or cashback on eligible purchases, enhancing the value proposition for users.

This compatibility with major card networks makes digital wallets a versatile tool for everyday online transactions, aligning with the global shift towards cashless societies.

Compatibility considerations for less common card types

Digital wallet compatibility with less common card types, such as store, loyalty, and premium rewards cards, is more nuanced.

Integrating these specialized cards varies by provider. Store cards, often limited to purchases at specific retail stores, may not be universally compatible with all wallet solutions.

However, many wallet providers recognize their value for customer loyalty and work to include them. This integration enables users to avail of store-specific benefits or discounts directly through their mobile wallet apps, enhancing the shopping experience.

Loyalty cards, used to accumulate points or rewards, also see varying levels of support. Some eWallets allow users to store and use these cards digitally, automatically applying rewards or discounts during transactions.

The challenge lies in different loyalty programs' diverse formats and systems, which may require additional collaboration between wallet providers and retailers.

One study in June 2023 suggests consumers are more than happy to use digital loyalty cards, coupons, and vouchers (image source).

General factors that may affect compatibility

There are three factors to consider.

Technology plays a pivotal role. For instance, widespread adoption of NFC technology has allowed digital wallets to become mainstream. Digital wallets can only work within the right hardware and software infrastructure.

Banking policies and regulations are another critical factor. Financial institutions have their own set of rules regarding online transactions, influencing which digital wallets they choose to partner with and support. These policies are often shaped by security concerns and the need to prevent fraudulent purchases.

Regional and international considerations also impact compatibility. A country’s level of digital infrastructure and regulatory environments can either facilitate or hinder the adoption of digital wallets. Some regions may have advanced digital payment systems well-integrated with local banking services, while others might not be at a stage to adopt such technologies.

Applications of digital wallets

Digital wallets aren't just for monetary transactions. Some other common types of applications include:

- Peer-to-peer transfers: Easy money transfers between friends when splitting a bill at a restaurant or sending money to a friend.

- Bill payments and subscriptions: You can automate multiple bill and membership payments using digital wallets

- Travel: Digital wallets make it easy to make payments through tap or QR codes as you travel. They can also store boarding passes, hotel keys, and travel insurance details.

- Public transport: In many places like the United Kingdom, digital wallets can be linked to public transportation systems, allowing users to tap through their phones.

- Healthcare services: Some digital wallets are equipped to store medical insurance information and prescriptions.

- Event ticketing: They can store and manage tickets for events like concerts and movies.

- Identification and documentation: Digital wallets can store digital versions of personal identification documents, like driver's licenses or student IDs.

- Cryptocurrency transactions: Some digital wallets are designed to buy, store, and sell cryptocurrencies.

- Emergency services: In emergencies, digital wallets can quickly access information like emergency contacts, health insurance details, and medical conditions.

Wrapping up

Integrating digital wallets with different bank card types offers convenience, speed, and enhanced security.

As we move towards an increasingly digital world, facilitating digital wallet technology for your customers is a smart choice. It simplifies transactions, tightens security, and accommodates a range of payment options and non-transactional functions, aligning with the evolving needs of modern consumers.

- Unlocking Customer Loyalty Through Personalization: Strategies for Retail, Finance, and Power Industries

- How to Use a Digital Wallet to Better Manage Your Spending

- The Future of Banking: Digital Wallets Transforming the Industry

- Digital Literacy in FinTech: Essential Skills for Your Workforce in 2024

- Demystifying Bank Card Types: A Comprehensive Guide to Digital Wallets and their Compatibility