The Switch to Cashless Society: Gauging Financial Inclusion in Egypt

In Egypt, financial inclusion has recently become a strategic focus on the government’s agenda. In emerging markets, financial inclusion has a direct impact on poverty reduction, minimization of income disparities, and economic growth.

Catering to the evolving consumer needs of affordable and accessible financial services, many governmental and private financial organizations are now striving to find the most actionable ways to improve the rates of financial inclusion in their countries. And Fintech has become the new oil for financial businesses, large retails, telecom providers, and many others—for all those planning to leverage new tech innovations while serving their end customers with exceptional long-lasting finance experiences.

With this, there are lots of traditional banks and financial businesses that are still on the fence about adopting digital transformation trends across their financial service infrastructure. What is the reason behind investing in FinTech software innovations for large-scale financial businesses in emerging markets? And how can financial inclusion influence the level of economic growth and, in particular, customer satisfaction with financial services?

This article is to shed some light on the global and regional stats of FinTech investment and how digital tech trends contribute to the overall economic development in the countries of the MENA region, namely Egypt.

Why are fintech solutions worth investing in?

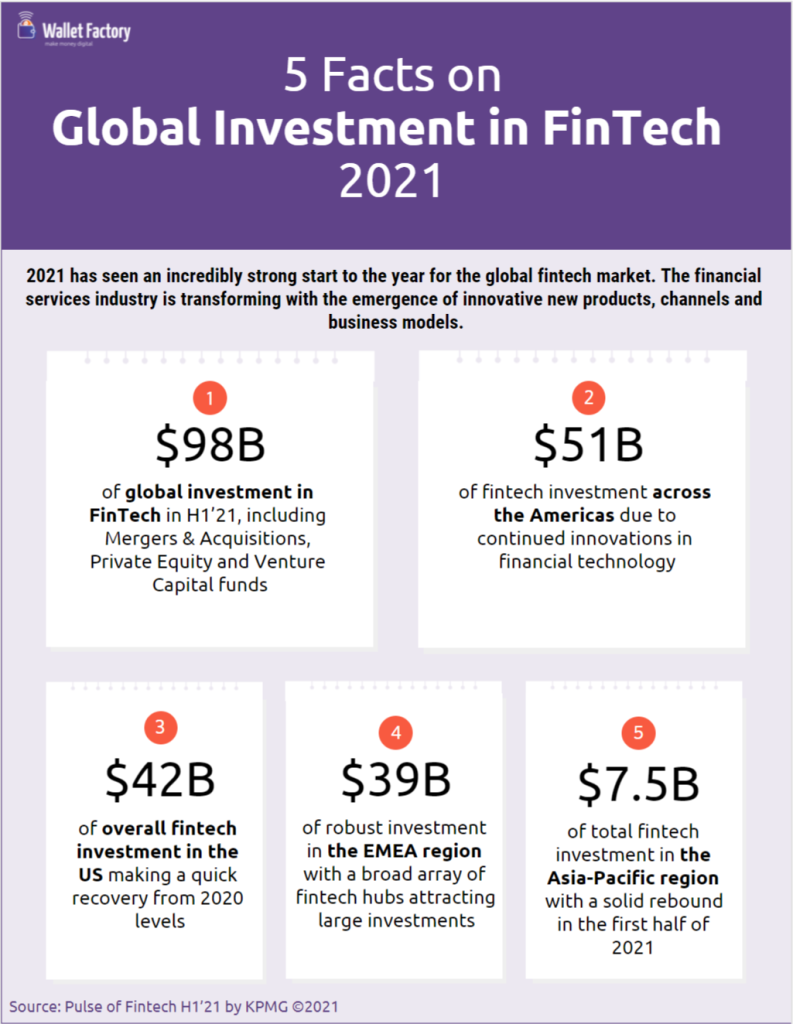

The global investment efforts in FinTech innovative software solutions are truly immense. According to the KPMG’s Pulse of Fintech H1 2021 Report, the global fintech investment reached $98 billion at mid-year, with 163 FinTech unicorns appearing in the first half of the year. After a slight investment slump in 2020, the figures for 2021 look pretty promising.

What is financial inclusion?

The World Bank Group (WBG) defines Financial Inclusion as an essential concept covering three aspects of financial services: usage, quality, and access. With this, however, the WBG researchers point out that the boost of financial inclusion alone is not the final goal of FinTech-driven innovations. What’s more important is its impact on overall development that ushers rapid economic growth in underbanked countries. The idea that financial inclusion contributes positively to financial stability proved true by the recent studies in the Finance Research Letters journal.

For their personal day-to-day financial operations, consumers strive to get affordable, easy-to-learn and use, and secure fintech software solutions. Combining all these factors can only make underbanked communities switch from traditional banking services to digital-driven transactions. Over the last decade, the boost of mobile penetration rates helped lots of mobile phone users easily move to online payment services, cutting down the unbanked population by 35%. Still, there remains much to be done regarding financial inclusion worldwide and the MENA region in particular.

Egypt: Key economic growth and development perspectives

Speaking about the MENA region, it is fair to start with Egypt as one of the most prominent countries, especially when it comes to improving financial inclusion. The potential of Egypt as an emerging FinTech hub is quite enormous. And the current tendency shows there is still much room for further improvement. According to one of the latest Harvard thesis studies on financial inclusion and sustainable growth in Egypt, the country had until recently only 33% of the adult population with full access to financial services.

Since then, both governmental and business entities have done their best to stimulate economic growth and accelerate the widespread adoption of digital financial services. The main development steps set to change the financial inclusion landscape in Egypt are as follows:

- Consistent improvement of the legal and regulatory framework that helps make digital financial services more accessible to unbanked communities, especially in remote and rural areas.

- Reinforcement of local market infrastructure by reducing transaction costs and improving the security and convenience across digital payment channels.

- Focus on financial literacy initiatives with the help of educational programs, media outlets, government incentives, and other promotional activities.

All this contributes significantly to the drastic increase in the country’s GDP size, with only one plausible setback in 2020 caused by the global pandemic.

Given the favorable situation for investors and finance software services providers to join the financial inclusion improvement initiatives, Egypt will likely become a FinTech flagship of the entire MENA region in 2022 and beyond. From consumers to merchants to banks and other financial service operators—all the stakeholders in Egypt truly deserve to gain open access to low-cost affordable digital financial services of high quality.

Luckily, Egyptian mobile phone users have already had an opportunity to tap into the benefits of world-class digital wallets and other finance software solutions. For instance, the recent launch of EasyCash, the first interoperable ePayment suite, was well-received by local consumers. The finance mobile application has become the first to fully meet all the latest governmental standards for QR code-based digital payments and acceptance. The digital wallet was developed in line with the best software development practices and delivered to the Egyptian market by Wallet Factory. The EasyCash use case opens up a plethora of vibrant opportunities to other mobile finance applications, which are soon to come to the Egyptian market. With more fintech solutions in place, consumers will benefit much from reasonable offerings based on fair competition.

Final thoughts

Technologically driven Egypt has so much to offer international investors and finance software service providers. In their turn, businesses can enable local underbanked communities with simplified access to affordable digital financial services while entering the local market. Together with the all-out governmental support, this will help Egyptian banks and eWallet operators attract lots of new consumers to opt for their online payment systems and eventually become a cashless society. In the long run, such financial inclusion will inevitably result in moving from poverty and inequality to countrywide economic growth.