Saudi Arabia: Unlocking the Potential for Financial Inclusion

Today, digital transformation comes in many ways ushering in a new era of how people interact in their everyday and business lives. Emerging technologies have become a staple in various industry verticals helping organizations enhance their overall performance and productivity.

The same holds true for the financial sector as digital disruption opens up new vibrant opportunities for banks, large retailers, telecommunication service providers, mobile operators, and other market players. With what is known as FinTech—a meaningful synergy of tech-enabled innovations coupled with financial instruments—small and midsize companies get a competitive edge when it comes to providing next-gen financial services to business users and customers.

With this, there are lots of traditional banks and financial businesses that are still on the fence about adopting digital transformation trends across their financial service infrastructure. What is the reason behind investing in FinTech software innovations for large-scale financial businesses in emerging markets? And how can financial inclusion influence the level of economic growth and, in particular, customer satisfaction with financial services?

Digital financial services: Global overview

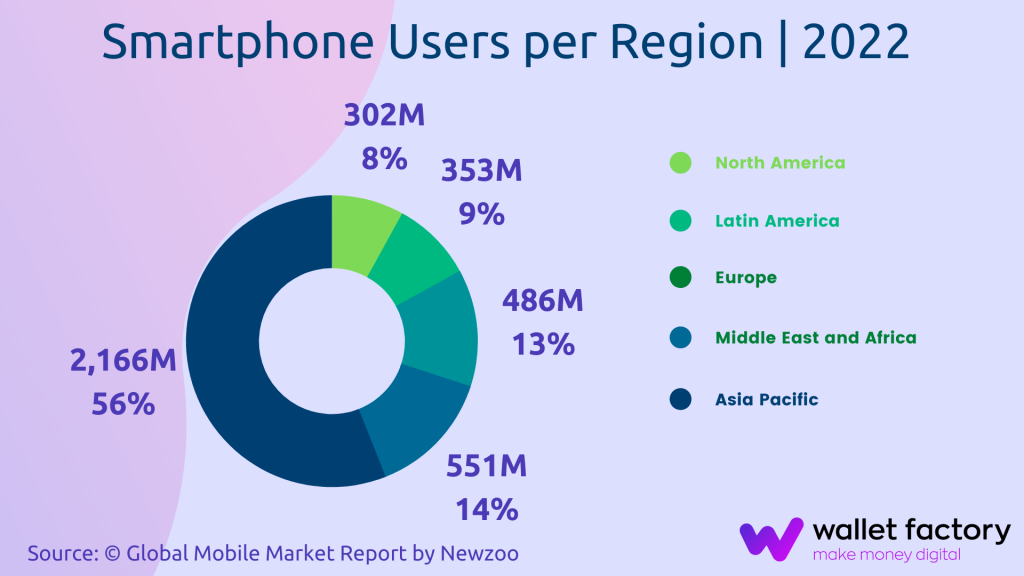

The switch to digital services is getting made from both ends, meaning that while businesses start introducing new technologies, internet and mobile phone penetration rates are rising high, especially in emerging markets. According to Newzoo’s global mobile market report, the number of smartphone users has reached close to 4Bn worldwide, with a +6% YoY growth rate.

Speaking about digital financial services, and given such soaring smartphone penetration rates, more and more FinTech innovations are getting widespread and adopted by end customers. For instance, Statista comes up with the following highlights and predictions on the topic for 2022 and beyond:

- Over 66% of senior bank executives confirm that FinTech has changed main banking products and services, namely eWallets and mobile payments, on a global scale.

- Digital Payments are projected to take the lion’s share of the FinTech market totaling almost $8 billion in transaction value by the end of 2022.

- The number of active customers of online payment services alone is anticipated to top 5 million users in 2025.

- Per customer, the average value of transactions is estimated to reach $35 thousand in 2022.

- Neobanks is expected to be the next big thing in FinTech, with a significant increase in revenue of nearly 40% by 2023.

Saudi Arabia: How the kingdom gains digital momentum

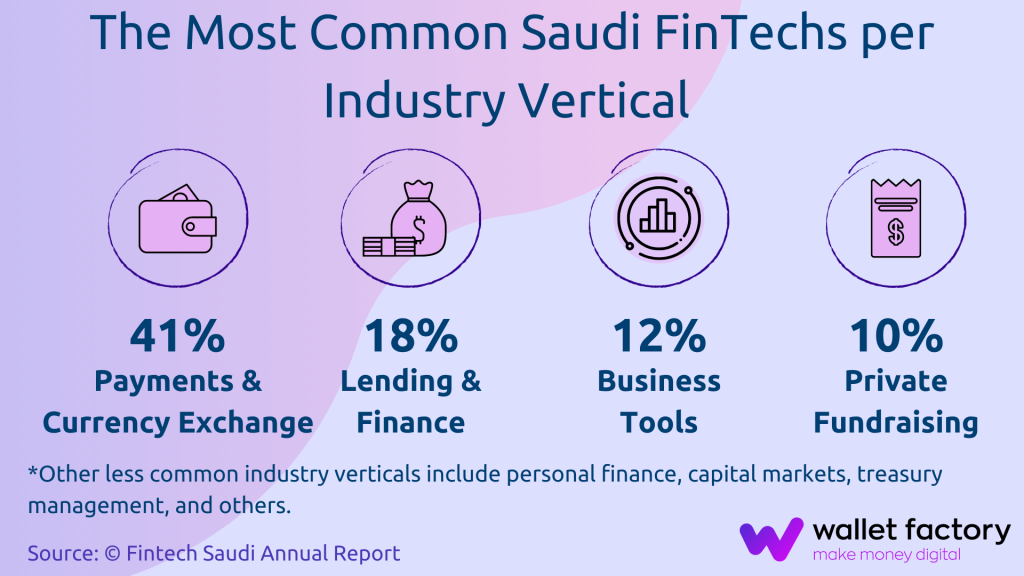

In these digital disruption times, Saudi Arabia does its best to harness the untapped potential of FinTech innovations across industries and underserved communities. For the MENA region, it was up until recently that only Egypt and the UAE could brag about their growing FinTech startups and local markets. But now, it seems to be high time for these countries to pass the innovative technology baton to Saudi Arabia.

Saudi Arabia: Providing regulatory basis for FinTech ecosystem

In 2021, the Kingdom received close attention from the world’s leading banks, governmental and private foundations, investors and business incumbents, and FinTech service providers. It became possible only due to enormous joint efforts made prior in 2018 by governmental regulatory bodies and foundations. To encourage international investment funds and streamline the growth of local FinTech startups, groundbreaking changes in the country’s banking policies took place.

SAMA (Saudi Arabian Monetary Authority), the central bank of the Kingdom of Saudi Arabia, alongside CMA (Saudi Arabia’s Capital Market Authority) provided extensive support for budding local businesses allowing for secure testing and experimenting with new digital financial technologies within a single sandbox environment and FinTech lab. This gave FinTech startups an opportunity to reveal the most actionable business models and services like P2P (peer-to-peer) transfers, eWallets, and international payments.

However, to create a holistic FinTech ecosystem and ensure the sector’s stable growth in the country, other players had to join the big-time game. As of 2022, the stakeholders committed to developing the digital financial hub in Saudi Arabia are the following:

- Government and regulators

- Research institutions and universities

- Mentoring incubators and accelerators

- Investors and business incumbents

- Users of digital financial services

- Technology firms and vendors

With digital transformation becoming a top priority for all the market players, the FinTech sector in Saudi Arabia shows remarkable progress in terms of regulatory friendliness and countrywide adoption. With some slight slowdowns in appearing new fintech startups caused by the pandemic, the shift to a cashless society in the Kingdom is here to stay.

Financial Inclusion in Saudi Arabia

One must realize, however, that the digitalization of financial services is not the ultimate goal. It serves as a robust tool to accelerate financial inclusion for the local unbanked and underbanked population, thus improving the overall economic growth in the Kingdom. According to Vision 2030, the most ambitious reform initiative introduced by Crown Prince Mohammed Bin Salman, the economy of Saudi Arabia has been driven to become the region’s most attractive financial destination.

To achieve these financial stability goals while reaching the underserved, SAMA and other government authorities together with the G20 Global Partnership for Financial Inclusion (GPFI) and the World Bank Group identified the three most prospective groups in Saudi Arabia that require all-in assistance and support in terms of improving financial inclusion across digital banking services and regulatory incentives. So, the key groups are:

- Youth

- Women

- SMEs (Small and Medium Enterprises)

With what might seem difficult to understand at first glance, this approach is a pitch-perfect way to address financial inclusion challenges while helping the segments that need it most of all.

For younger generations and women, it is of paramount importance to become tech-savvy as soon as possible to be capable of driving technology innovations countrywide. For small and midsize businesses, it is imperative to have a government-backed regulatory strategy for the smooth development and launch of their FinTech projects.

There are also some other vulnerable groups that still lack cutting-edge digital financial services. The King Khalid Foundation, a non-profit institution aimed at improving social and economic development in Saudi Arabia, defines the next categories that require assistance in enhancing financial inclusion:

- Low-income groups

- Less-educated individuals

- Persons outside the labor force

- Those living in remote and rural areas

Bottom line

Accelerating financial inclusion rates is only possible via diversifying the existing traditional financial system along with digital transformation and governmental incentives. More importantly, new tech innovations should be adopted concurrently by both underserved customers and financial companies and startups. With all that said, the Kingdom of Saudi Arabia has all the odds to become the next global FinTech hub. Read more on a blog by Wallet Factory to always stay current with the latest FinTech trends.