Wallet-as-a-Service: The Next Digital Payment Revolution in Ecommerce?

Did you know that 17% of eCommerce shoppers abandon their carts because of a lengthy checkout process?

It’s apparent that complex checkouts remain a challenge for many eCommerce companies. And this is just the tip of the iceberg.

But thanks to innovation in fintech, there’s hope.

Enter: Wallet as a Service.

If you didn’t know this term before, you should know it now. Because it is going to be your savior.

What is Wallet-as-a-Service?

You’ve surely heard of third-party digital wallets. Do you know that 70 million users across the world use blockchain-based, open and closed-loop, and other types of digital wallets? If you are at the very beginning, check out first the benefits of blockchain apps. When you are done with the reading and have cleared the things up, let’s go further and deal with mobile wallet apps.

Digital mobile wallets

Global Payments report by McKinsey

Mobile applications that allow customers to make in-app eCommerce and in-store purchases at merchants (closed-loop, bank transfer based, or card linked).

Be it a large retailer, bank, telecom, or wallet operator—all forward-looking businesses perfectly know that customer demands and expectations with brand are evolving now. In particular, they struggle to get more convenient and secure payment experiences. J.P. Morgan revealed the next ways how integrating digital wallets can improve and future-proof your payments strategy:

- Cashierless technology

- Faster transactions for customers and merchants

- Recurring customer relationships

- Reduced payments complexity

- Optimized sales channels

- Contextual payments

- Embedded financial services

- Frictionless checkout & payment customer experiences

Now imagine if you could embed new digital payments technology solutions into your eCommerce store? Imagine if you could digitize your entire business value chain through various fintech offerings. That’s WaaS for you. Just like how you pay a SaaS provider to use their tool, you pay the fintech provider to pay for their wallets on a subscription basis.

WaaS is an innovative type of software delivery model that enables financial and non-financial businesses to easily launch their own digital wallet business. Integrating WaaS is the quickest way to digitize and start capitalizing on your customers’ and merchants’ transactions.

53%of merchants plan to expand payment methods in 2022

The 2022 Commerce and Payment Trends Survey from Global Payments

Of the new payment methods they plan to accept:

• 60% will add digital wallets

• 60% plan to take QR-code payments

• 51% will start accepting digital invoicing

Wallet-as-a-service (WaaS) is a comprehensive solution that supports and integrates e-wallets for cards, banks, and digital money transitions, everything under a single tool. They facilitate non-financial companies (like eCommerce) to launch their own branded wallets for smooth money transfers between their customers and business users like agents and merchants.

Wallet-as-a-service has filled in the demand for embedded finance solutions, facilitating various market players like large retailers, telecoms, banks, and wallet operators to respond quickly to changing customer needs. They’re all the rage and for all the right reasons.

Why Should you Consider WaaS?

eCommerce businesses can leverage WaaS in various ways. It is built on the foundation of frictionless payments and makes the customer experience smooth at every touchpoint.

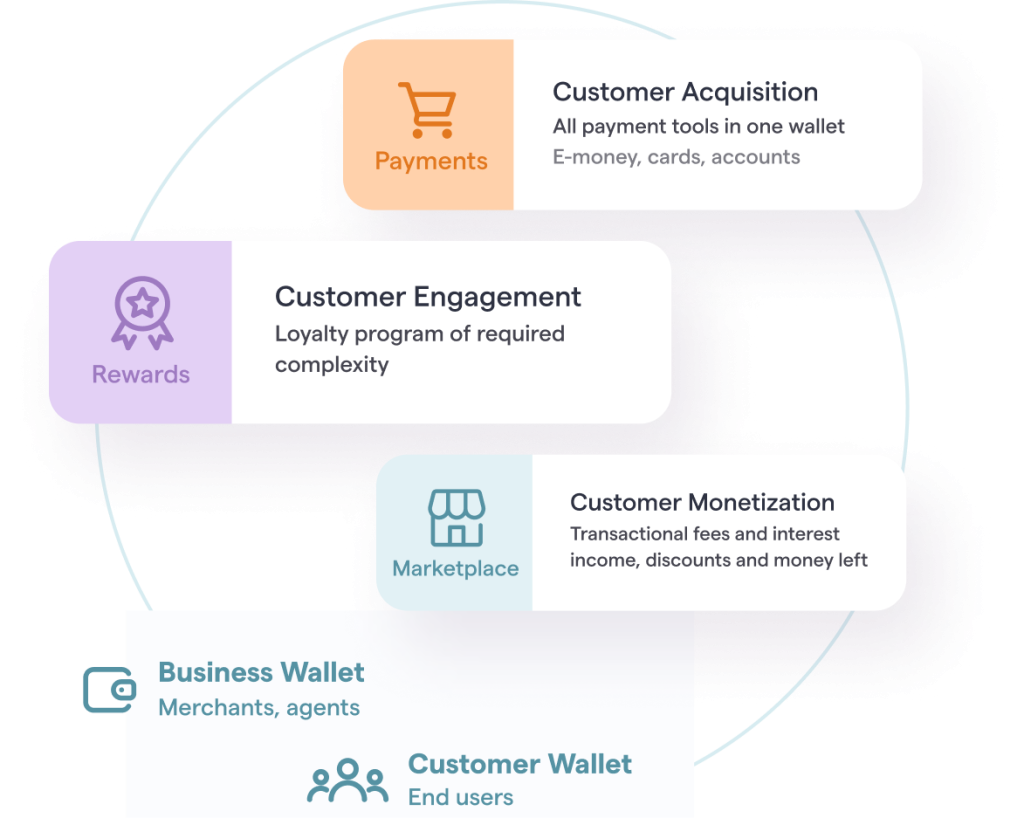

On top of this, WaaS helps your financial business at every customer journey stage, especially when it comes to acquiring, engaging, and retaining your consumers and merchants. Providing your customers and business users with app-based digital wallets creates new added brand value and gives you new opportunities to capitaliza on your customer base with enduring revenue streams.

Reduced Cart Abandonment

Imagine this: You have a customer that’s almost reached the checkout page. They then have to fill out a form. They are then directed towards a review page, and finally to the payment page. By this time, it’s entirely possible that the customer has lost the will to go ahead with the purchase.

A complex checkout process is still very much prevalent in eCommerce. Shoppers want to cross the finish line and a complicated checkout process won’t help with that. It can slow your shoppers and take away the positive experience, ultimately deterring them from ever purchasing on your site. WaaS can help you solve this. It provides a one-click solution to payments and facilitates real-time transactions that keep all these hassles at bay. It significantly reduces the steps involved in checkout and provides greater flexibility of payment options to the customer.

Higher Control of the User Experience

Digital wallets have been around for quite a while. And they too are popular for their frictionless payments. But WaaS offers that and much more. With WaaS, merchants can offer branded wallets at the checkout instead of integrating third-party payment gateways. This gives them a higher authority to control the user experience at every point of the buyer’s journey.

WaaS providers don’t just offer digital wallets. They also include other financial services that you can offer your users. You can boost business engagement with personalized rewards and allow them to pay for various other transactions such as international remittances, vouchers, and mobile gifts.

Higher Service Range

As an eCommerce store, you don’t just have monetary transactions with your customers but also with your vendors, your eCommerce order fulfillment provider, your call centers, etc. WaaS solves the issue of cross-border compatibility and paves the way for businesses to make microtransactions. Again, since the concept of WaaS isn’t just limited to payments, you can experiment with providing new financial products to your customers and increase the range of your financial services.

White Label Opportunities

Most digital wallets have brand names that even the user knows. And while third-party payment gateways are great, you want to ensure your brand is up there too. You want to take over the payments and integrate your tool that your customers will use time and again. It fosters greater brand awareness and loyalty.

Many WaaS providers offer white label options where they offer the software and backend support but let the eCommerce store have their brand name. It saves you the hassle to build the wallet app entirely by yourself and saves you money too. Utilizing brand name generators can be a valuable resource in the process, helping you come up with unique and catchy names that resonate with your target audience, further enhancing your brand presence in the digital wallet market.

Easy to Launch

Just like how you integrate a SaaS product by yourself, you can integrate WaaS. The wallet can seamlessly integrate with your existing infrastructure. It’s less complicated, easy to use, and provides you with a quick way to go digital.

How to Get Started with WaaS?

As mentioned before, building a wallet on your own will probably involve a lot of time and effort. There are numerous aspects that are out of your expertise. Getting the right tech stack to get regulatory compliance. There are many service providers in the market that take care of all these things and enable you to embed a wallet into your existing store.

The pricing is quite flexible. You don’t have to pay a large sum for a wallet that doesn’t fit your system. WaaS usually has a pay-as-you-grow approach. As and when you decide to scale and add more services to your eCommerce store, you can increase your payment to them accordingly.

It’s also important to do the due research in choosing the right vendor. Check for the range of products they offer and how they can seamlessly integrate with your eCommerce store. Check for the licenses and the risks and compliance functions. You want to ensure that your customers can securely make their payments. And the best services will have security systems in place to ensure the merchants stay compliant with the payment security standards.

WaaS: Finishing Thoughts

eCommerce stores are always looking for ways to personalize more and strive toward a wholesome customer experience. And having a built-in wallet system at checkout can help them achieve that. As an eCommerce store with a large customer base, you can now offer financial services without having to procure a banking license.

Be it creating a virtual card, making deposits, withdrawals, making transfers, or accessing loyalty programs, embedding a digital wallet into your store facilitates access to new products and offerings that you can integrate into your customer’s shopping experience and make it a wholesome one.

Wallet Factory has got the right expertise of implementing digital wallet services on a subscription basis. Our clients have already harnessed the WaaS opportunities launching their financial businesses in the Southeast Asia, MENA, and LatAm regions. We are always open for new cooperation, just contact us to know everything in detail.