Digital Wallets for Banks:

Get Faster Opportunities to Acquire Unbanked Population

Accelerate your revenue growth with digital wallets to seamlessly enter unbanked markets, eliminating barriers to traditional banking services and captivating previously unreached audiences. Embrace a cost-efficient, fast time-to-market solution for expanding your bank’s horizons.

Tap into the Untapped

Seize the Global Market Potential of Financial Inclusion and Digital Payments

Launching your digital wallet business is never late, but the sooner you start, the better competitive advantage you will get.

Why now is just the right time for your bank to jump in:

Unlocking Financial Inclusion

Over 1.7 billion adults worldwide still lack access to formal financial services.

Market of the Future

Global digital payment transactions are set to reach $10.07 trillion by 2026, growing at a CAGR of 13.5%.

Untapped Opportunities

The unbanked population represents a vast market segment waiting to be served.

Emerging Economy Advantage

Explore immense growth potential in digital wallet solutions within rapidly evolving economies.

Regulatory Support

Governments and regulatory bodies actively promote financial inclusion initiatives.

Expand Your Business Horizons

By leveraging digital wallet solutions, banks can broaden their customer base and revenue streams.

<span data-metadata=""><span data-buffer="">Empowering Financial Inclusion

<span data-metadata=""><span data-buffer="">Wallet Factory's Unique 3-in-1 Digital Wallet Platform

Wallet Factory, a leading e-wallet provider serving banks and non-banking financial institutions across developing markets in Africa, MENA, and LatAm. Our mission is to facilitate the transition from a “Cash Heavy” to a “Cash Lite” society, aiming to include unbanked citizens into the financial system through our clients.

Seamlessly Integrated Digital Wallet

Experience the convenience of a separate payment instrument with a built-in ledger and personalized loyalty reward functionality, captivating customers and enhancing their financial journey.

Gateway to a Mobile Marketplace

Increase your customer engagement and satisfactioon with mobile gifts, a valuable service that enables merchants and customers to send personalized gift certificates for specific products or e-money. Get a custom feature-rich solution to build long-lasting customer relationships and loyalty while serving various marketing purposes.

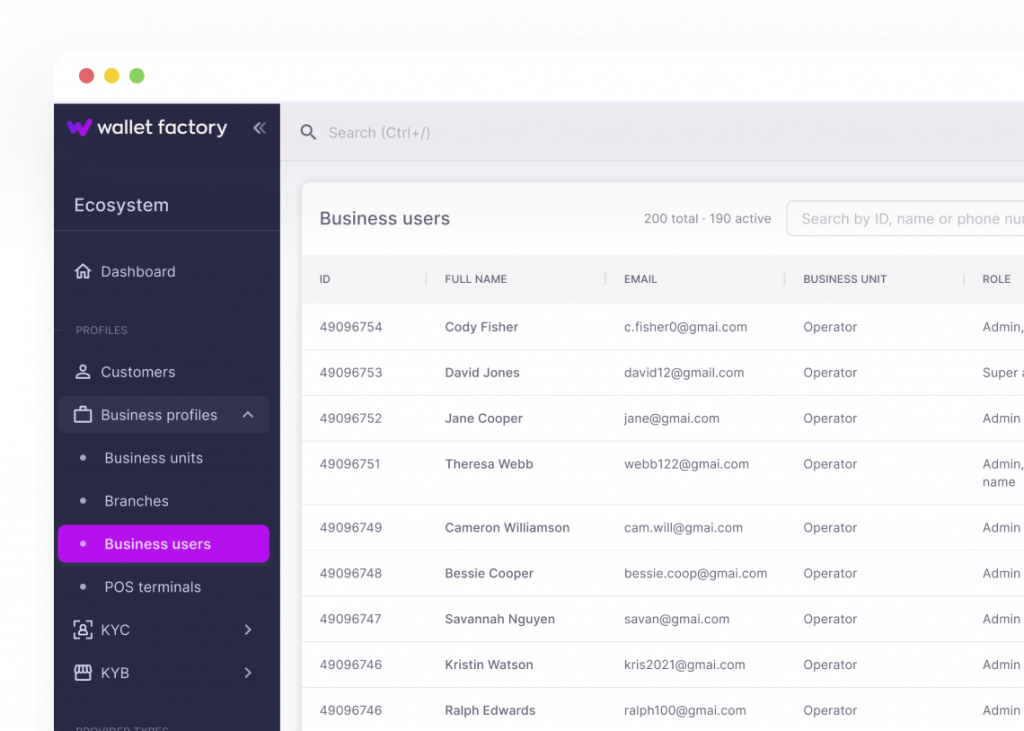

Comprehensive Ecosystem Tools

Unify users, merchants, agents, and other payment instruments on one powerful platform. Our ecosystem tools foster seamless connections, unlocking new possibilities for financial transactions and interactions.

<span data-metadata=""><span data-buffer="">Solution Highlights

<span data-metadata=""><span data-buffer="">Stay Ahead with Digital Wallet Platform by Wallet Factory

Simplified Onboarding Process

- Instant access to financial services through a seamless, fully digital onboarding experience.

- No physical documentation required, ensuring immediate account activation.

- Inclusive approach reaches individuals across diverse backgrounds, genders, and education levels.

Multiple Wallet Levels

- Tailored wallet levels with varying transactional limits based on user profiles.

- Users can unlock higher transaction volumes by digitally providing additional documents.

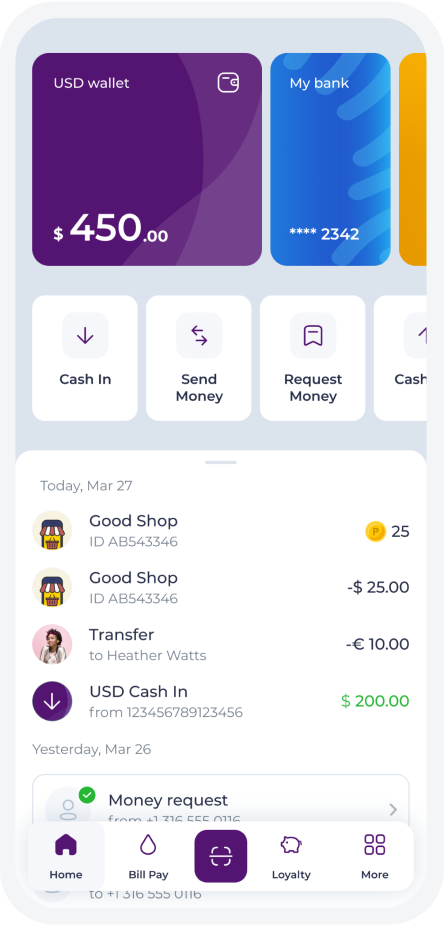

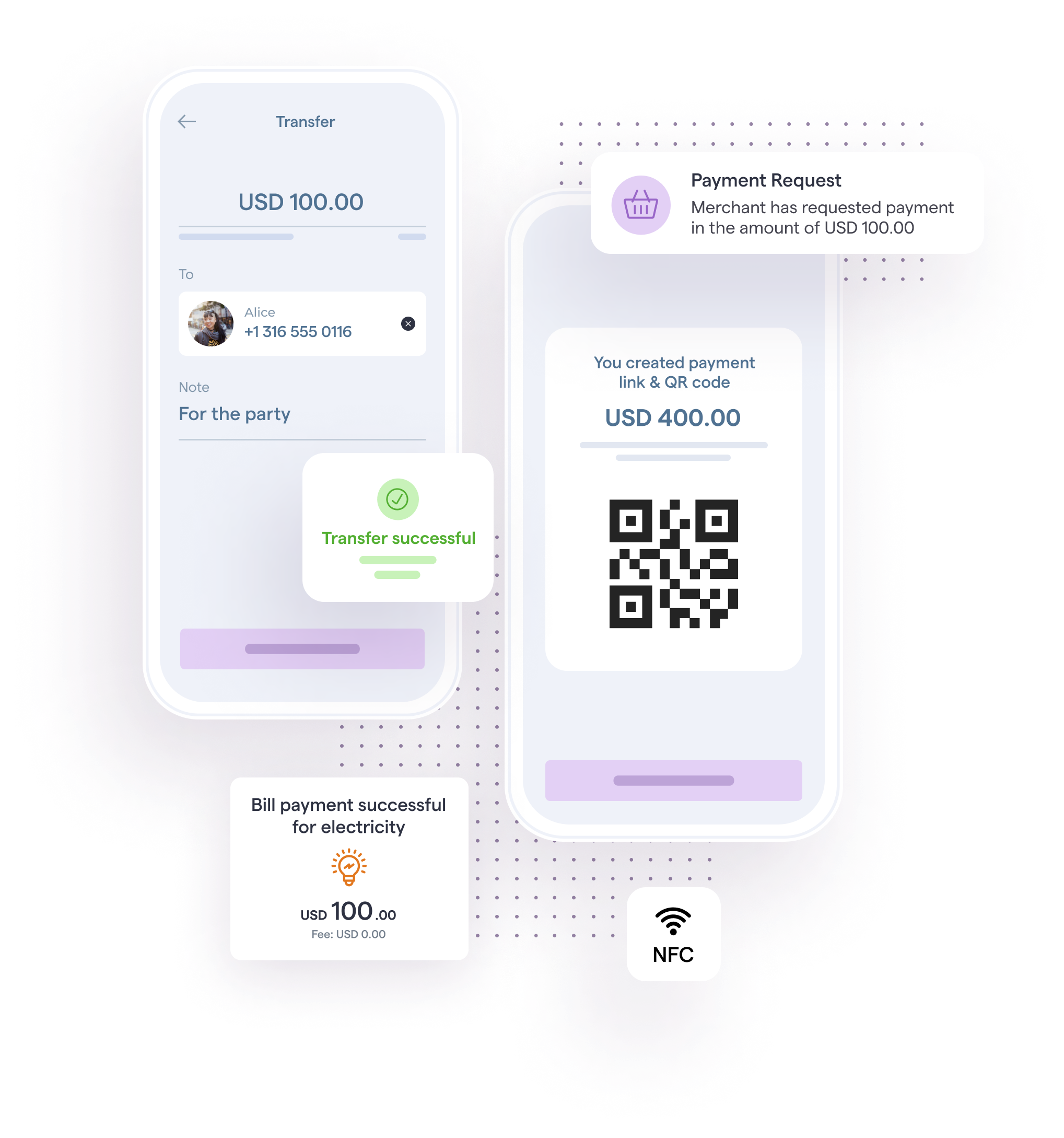

Versatile Transaction Options

- Peer-to-peer transfers for seamless money exchanges between individuals

- Bill payments to utility companies, schools, and government offices

- QR code payments empower merchants for easy and secure transactions

- Direct salary payments to digital wallets, reducing transaction costs

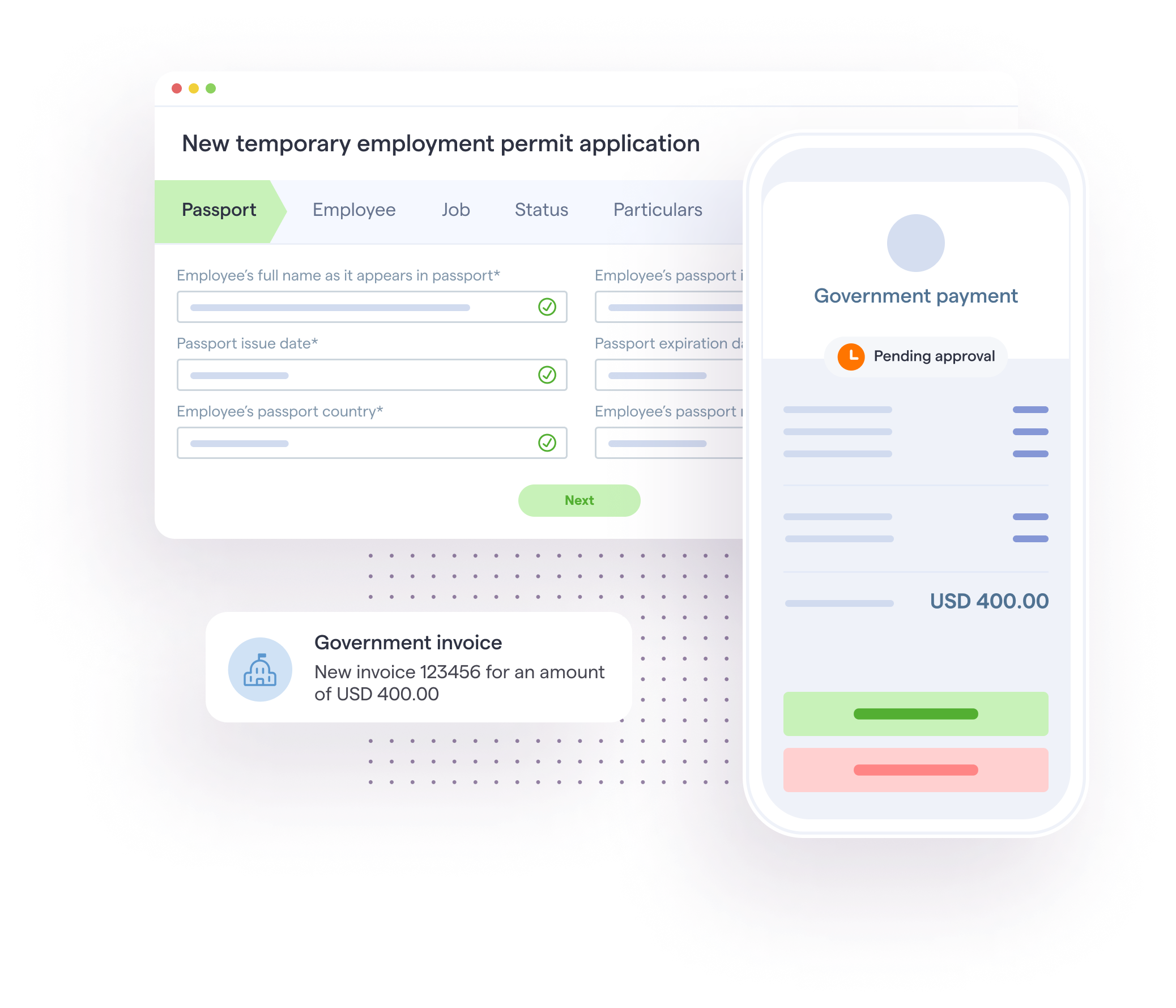

Government Payment Integration

- Streamlined government payments for work permits, immigration, taxes, and certificates.

- Convenient and efficient method to complete government-related transactions.

Cashless Top-up and Cash-out

- Multiple channels to top-up wallets, including retail agents and linked bank accounts

- Easy cash-out functionality to transfer electronic money from wallets to bank accounts

Expense Tracking and Budgeting

- Unique expense tracking feature to monitor and manage income and expenses

- User-friendly digital solution replacing manual expense recording methods

<span data-metadata=""><span data-buffer="">Join us in our pursuit of financial inclusion

<span data-buffer="">Vast opportunities to Tap Into <span data-metadata="">

<span data-buffer="">Helping You Reinforce Your Traditional Banking Business<span data-metadata="">

We do respect the way you run your financial business. But when you reach a business growth limit, it’s time to leverage innovative tech-enabled solutions that help you win new previously unbanked audiences.

<span data-buffer="">The reasons why banks in Africa and other rapidly developing economies are interested in integrating a Digital Wallet platform:<span data-buffer="">

Financial Inclusion

A significant portion of Africa’s population remains unbanked or underbanked. Digital Wallets can provide these individuals with access to financial services, such as money transfers, payments, and savings, without the need for a traditional bank account.

Mobile Penetration

Africa has a high rate of mobile phone usage, even in rural areas. This makes it an ideal environment for mobile-based financial services like Digital Wallets.

Lower Operational Costs

Africa has a high rate of mobile phone usage, even in rural areas. This makes it an ideal environment for mobile-based financial services like Digital Wallets.

Increased Customer Engagement

Digital Wallets can increase customer engagement by offering a convenient and user-friendly platform for financial transactions. They can also be integrated with loyalty and rewards programs to further enhance customer engagement

New Revenue Streams

Digital Wallets can open up new revenue streams for banks. They can charge fees for certain transactions, and they can also earn revenue from third-party partnerships, such as with retailers or service providers.

Competitive Advantage

As more and more banks and fintech companies offer digital financial services, having a robust and user-friendly Digital Wallet platform can give a bank a competitive edge.

Regulatory Support

Many African governments and regulatory bodies are supportive of digital financial services as a means to increase financial inclusion. This can make it easier for banks to launch and operate Digital Wallet platforms

Innovation and Future-Proofing

As technology continues to evolve, banks that adopt digital solutions like Digital Wallets are better positioned to adapt to future changes and innovations in the financial services sector

Proven Experience

Wallet Factory has a track record of successful implementations of Digital Wallet platforms in various markets. This proven experience can give banks confidence in the quality and reliability of the platform

Quick Deployment

Wallet Factory’s platform can be deployed in 3-4 months, which is a relatively short time frame for such a complex system. This allows banks to quickly launch their digital wallet services and start serving customers.

Subscription Pricing

Wallet Factory offers a subscription pricing model, which can be more affordable for banks, especially those in developing markets. This model allows banks to start offering digital wallet services without a large upfront investment

Comprehensive Solution

Wallet Factory’s platform offers a 3-in-1 approach, providing a digital wallet, tools for the payment ecosystem, and a base for a mobile marketplace. This comprehensive solution can meet a wide range of a bank’s needs.

Customization and Branding

Wallet Factory’s platform allows banks to launch their own branded digital wallet, enhancing their brand’s visibility and customer engagement. The platform can also be customized to meet the specific needs and requirements of each bank

Integration with Existing Systems

Wallet Factory’s platform can be integrated with a bank’s existing core banking system, allowing for seamless operations and data exchange.

Scalability

Wallet Factory’s platform is scalable, allowing banks to easily expand their digital wallet services as their customer base grows.

Ongoing Support and Updates

Wallet Factory provides ongoing support and updates for their platform, ensuring that it remains up-to-date with the latest technological advancements and security standards.

Financial Inclusion

A significant portion of Africa’s population remains unbanked or underbanked. Digital Wallets can provide these individuals with access to financial services, such as money transfers, payments, and savings, without the need for a traditional bank account.

Mobile Penetration

Africa has a high rate of mobile phone usage, even in rural areas. This makes it an ideal environment for mobile-based financial services like Digital Wallets.

Lower Operational Costs

Africa has a high rate of mobile phone usage, even in rural areas. This makes it an ideal environment for mobile-based financial services like Digital Wallets.

Increased Customer Engagement

Digital Wallets can increase customer engagement by offering a convenient and user-friendly platform for financial transactions. They can also be integrated with loyalty and rewards programs to further enhance customer engagement

New Revenue Streams

Digital Wallets can open up new revenue streams for banks. They can charge fees for certain transactions, and they can also earn revenue from third-party partnerships, such as with retailers or service providers.

Competitive Advantage

As more and more banks and fintech companies offer digital financial services, having a robust and user-friendly Digital Wallet platform can give a bank a competitive edge.

Regulatory Support

Many African governments and regulatory bodies are supportive of digital financial services as a means to increase financial inclusion. This can make it easier for banks to launch and operate Digital Wallet platforms

Innovation and Future-Proofing

As technology continues to evolve, banks that adopt digital solutions like Digital Wallets are better positioned to adapt to future changes and innovations in the financial services sector

Proven Experience

Wallet Factory has a track record of successful implementations of Digital Wallet platforms in various markets. This proven experience can give banks confidence in the quality and reliability of the platform

Quick Deployment

Wallet Factory’s platform can be deployed in 3-4 months, which is a relatively short time frame for such a complex system. This allows banks to quickly launch their digital wallet services and start serving customers.

RESHAPING FINANCIAL LANDSCAPE

The Success of E-kyash and the Belize Bank Partnership Harness the digital wallet potential just like other banks!

Witness the remarkable success story of E-kyash, the pioneering digital wallet solution, in collaboration with the Belize Bank Ltd. Together, we have revolutionized Belize’s financial landscape, driving financial inclusion and achieving significant milestones.

Achievement in Financial Inclusion:

- E-kyash has played a pivotal role in advancing Belize's financial inclusion agenda

- Immediate access to financial services provided to the unbanked population.

- Contribution to the government's national financial inclusion strategy.

Impressive Adoption Rates:

- E-kyash has experienced widespread adoption across diverse user segments.

- Rapidly expanding customer base, including adults, youths, women, and businesses. In just a few months, the mobile wallet app acquired nearly 30% of the previously unbanked population.

- Addressing the needs of various underserved user groups, gaining their trust and loyalty.

Positive Impact on the Economy:

- E-kyash has made a tangible impact on Belize's sustainable development and poverty alleviation goals.

- Empowered individuals and businesses to manage finances more efficiently.

- Reduced reliance on cash transactions, fostering a shift towards a "Cash Lite" society.

Value delivered

The results of app implementation are quite impressive as customers and business users started widely utilizing E-kyash in their day-to-day banking operations:

*Since the project launch in 2021

“E-kyash has revolutionized the way financial services are delivered today in Belize. The FinTech app has won widespread approval by both B2B and B2C bank customers with its usage growth rates exceeding exponentially. Together with Wallet Factory, we already have a strategy roadmap that will add much value to the Belizean market, drive financial inclusion, and bring not only modern financial services but also refreshing experience providing a brand new payment method for the everyday usage along with a lot of excitement to the Caribbean market and beyond.” —

Agata Ruta

Chief Operating Officer at the Belize Bank Limited

getting a competitive edge

The Benefits of Implementing a Digital Wallet Platform by Wallet Factory

Embrace the benefits of Our Digital Wallet Platform for your banking business:

Increased Customer Base and Revenue Streams

- Reach untapped market segments, including the unbanked population and underserved communities

- Attract new customers seeking convenient and accessible financial services.

- Generate additional revenue through transaction fees, merchant partnerships, and value-added services

Strengthened Customer Relationships and Loyalty

- Provide a seamless and user-friendly digital experience, enhancing customer satisfaction.

- Build stronger relationships by meeting evolving financial needs.

- Foster customer loyalty through personalized offerings, rewards programs, and targeted promotions.

Market Differentiation and Competitive Advantage

- Stand out from competitors with innovative digital banking solutions

- Position your bank as a leader in financial technology and digital transformation

- Differentiate your brand by addressing the specific needs of unbanked populations and underserved segments

Cost Savings and Operational Efficiency

- Reduce reliance on physical branches and associated costs

- Streamline manual processes and paperwork with digital onboarding and transactions

- Lower operational expenses through digital payments and automated processes

Enhanced Data Insights and Analytics

- Gain valuable insights into customer behavior and preferences through transaction data

- Utilize data analytics for informed decision-making and personalized customer offerings

- Improve risk management and fraud detection through advanced data analysis capabilities.

<span data-buffer="">Flexibility and Security<span data-buffer="">

<span data-buffer="">Empowering Banks with Customization and Peace of Mind<span data-buffer="">

Discover the unparalleled flexibility and security offered by our digital wallet solution. We understand that every bank has unique requirements, which is why our solution stands out in the following ways:

Tailored Solution for Banks

- Flexible customization options aligned with your bank's branding, user interface, and user experience.

- Personalization to meet specific regulatory requirements and compliance standards

- Adaptability to accommodate unique features or functionalities desired by your bank.

Integration with Existing Systems

- Seamless integration with your bank's core banking systems and infrastructure.

- APIs and protocols for smooth integration, ensuring a cohesive ecosystem and interoperability.

- Data synchronization and real-time updates for a unified and synchronized banking experience.

Secure Data Exchange

- Robust security measures protecting user data and transactions

- Encryption protocols and secure communication channels that ensure the safeguarding of sensitive information.

- Compliance with data privacy regulations and industry standards, building and maintaining customer trust.

Scalable Architecture

- Built on a scalable architecture to accommodate future growth and increased user demand

- Handling a growing user base, transaction volumes, and evolving market needs seamlessly.

- Scalable resources and infrastructure to provide a smooth and uninterrupted user experience.

<span data-metadata=""><span data-buffer="">Expertise that Brings You Value

<span data-metadata=""><span data-buffer="">Get a Trusted Partner in Digital Wallet Development

Extensive Experience

Compliance and Security

Focus on compliance, data privacy, and security to ensure the integrity of user information and transactions

Dedicated Technical Team

Committed developers, architects, and engineers that provide top-notch tech solutions, continuous training, and prompt support

Collaborative Approach

Streamlined Implementation Process

From Vision to Success

Our implementation process is designed to ensure a seamless and successful deployment of your digital wallet solution. We provide comprehensive support and guidance throughout the journey. Here’s a breakdown of the stages:

1

Requirement Gathering

- Collaboratively define specific requirements and objectives for the digital wallet solution

- In-depth discussions to understand your bank's unique needs and customization preferences.

- Create a detailed project roadmap and timeline for transparent implementation.

2

Solution Design and Customization

- Design the digital wallet solution architecture based on gathered requirements.

- Customize the solution to align with your bank's branding and user experience.

- Ensure compliance with regulatory standards and security protocols.

3

Development and Integration

- Leverage our technical expertise to develop the digital wallet solution using cutting-edge technologies.

- Seamlessly integrate the solution with your existing banking systems and infrastructure.

- Rigorous testing to ensure stability, security, and functionality.

4

User Acceptance Testing

- Engage stakeholders and users to participate in user acceptance testing

- Gather feedback and address any issues to optimize performance

- Conduct multiple rounds of testing for a robust and user-friendly experience

5

Training and Onboarding

- Provide comprehensive training to your staff on using and supporting the digital wallet solution

- Offer user-friendly documentation and resources for ongoing support

- Ensure a smooth onboarding process for end-users through informative guides and tutorials

6

Go-Live and Ongoing Support

- Facilitate a seamless go-live process, ensuring a smooth transition to the live environment

- Offer ongoing technical support and maintenance to address any concerns

- Continuously monitor and update the solution with new features and enhancements.

Pricing and ROI

<span data-metadata=""><span data-buffer="">A Promising Investment in Digital Wallet Business

Our digital wallet solution comes with a competitive pricing model that ensures a strong return on investment (ROI) for banks.

Pricing Model

- Tailored pricing options to accommodate your bank's specific needs and scale.

- Flexible choices, including licensing fees and transaction-based models.

- Transparent pricing aligned with the value delivered by our digital wallet solution.

Cost-saving Benefits

- Streamline manual processes and paperwork, reducing operational costs.

- Minimize expenses associated with physical branches and cash handling.

- Eliminate costs tied to traditional payment methods, embracing digital efficiency.

Revenue Generation

- Drive customer engagement and loyalty with a seamless digital experience.

- Unlock new revenue streams through transaction fees and merchant partnerships.

- Capitalize on value-added services and premium features for additional revenue.

Return on Investment (ROI)

- Achieve a robust ROI with increased customer acquisition and retention.

- Leverage the digital wallet platform for enhanced cross-selling opportunities.

- Improve operational efficiency and resource utilization, leading to cost savings.

CONTACT US

Book your demo

session now!