Digital Wallet (Prepaid eWallet) in Saudi Arabia

Digital Wallet or eWallet or Prepaid payment instrument is a flexible and cost-efficient cashless solution for retail payment.

The Open-loop solution usually operates on electronic or mobile money, closed-loop solution, such cases as Mono-Purpose Prepaid cards, Prepaid dedicated account or vouchers.

eWallet allows extending own payment business without starting from the scratch.

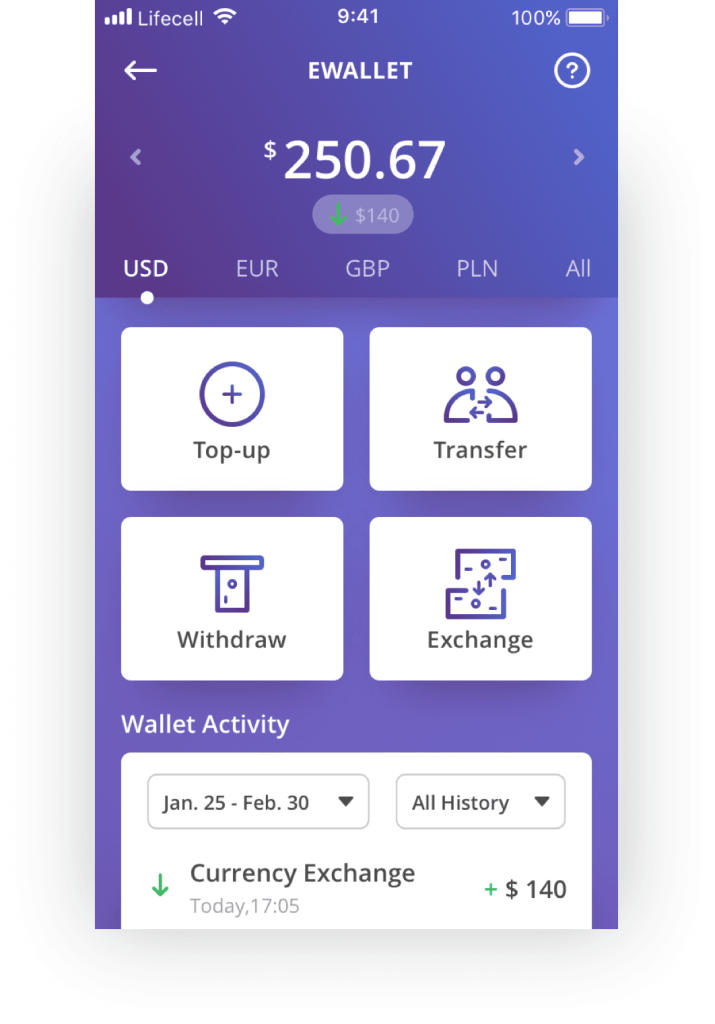

Key Digital Wallet elements

Digital Wallet solution may consists of

● Processing platform that allows to issue and manage Prepaid instruments like electronic or mobile money

● Variety of interfaces for end-users (customers): mWallet (mobile App for iOS and Android), web interface, OTP or USSD access to the wallet

● Variety of interfaces for merchants: QR POS (business mobile App for iOS and Android), web interface

● Administrative panel for Digital Wallet operator, customer support team, technical team, merchants and partners

Main wallet types

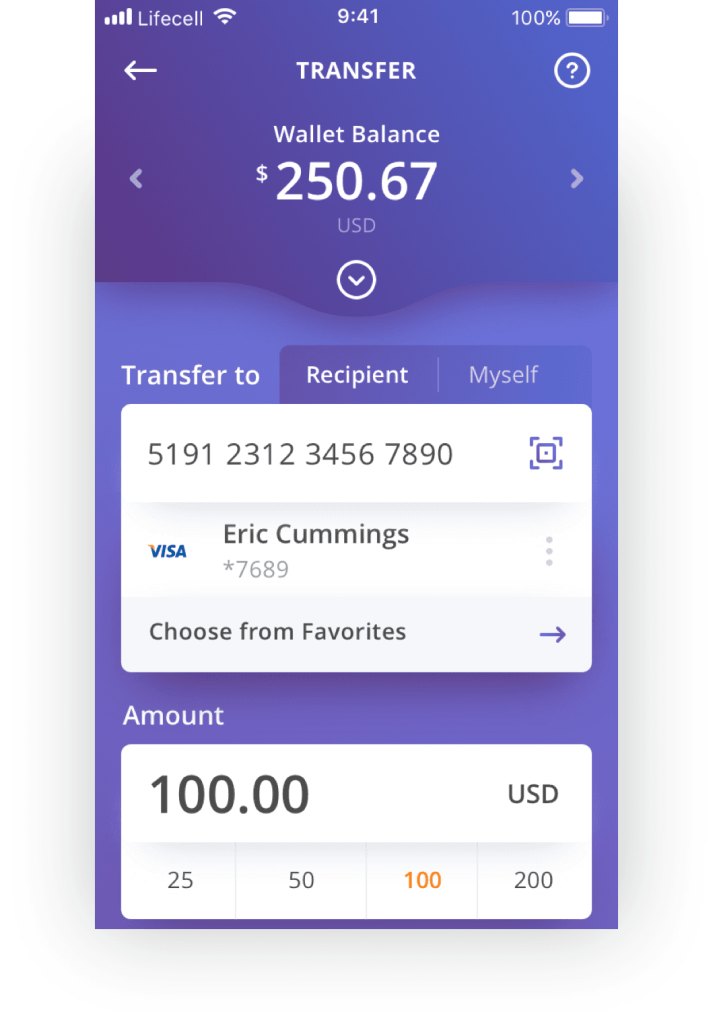

● Customer wallet – end-users’ Prepaid payment tool to make payments and transfers

● Merchant wallet – payment tool for receiving money from the end-users

● Agent wallet – an instrument for cash agents to convert cash into e-money and backwards (allows end-users to top up and withdrawal from eWallet)

● Issuer wallet – for e-money issuer

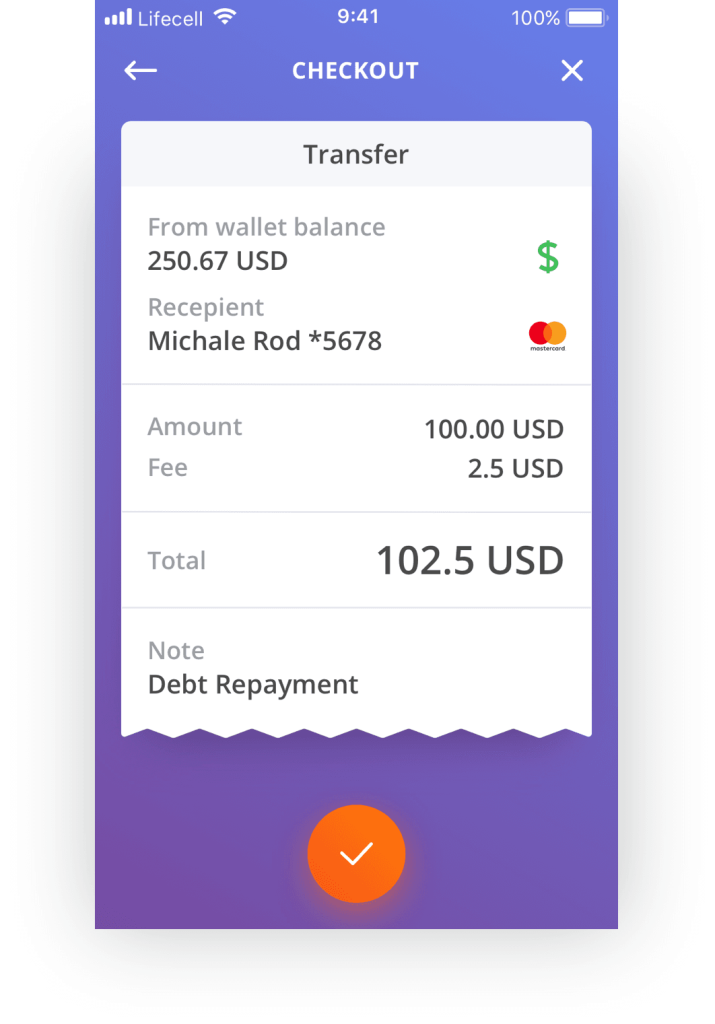

Basic transaction types

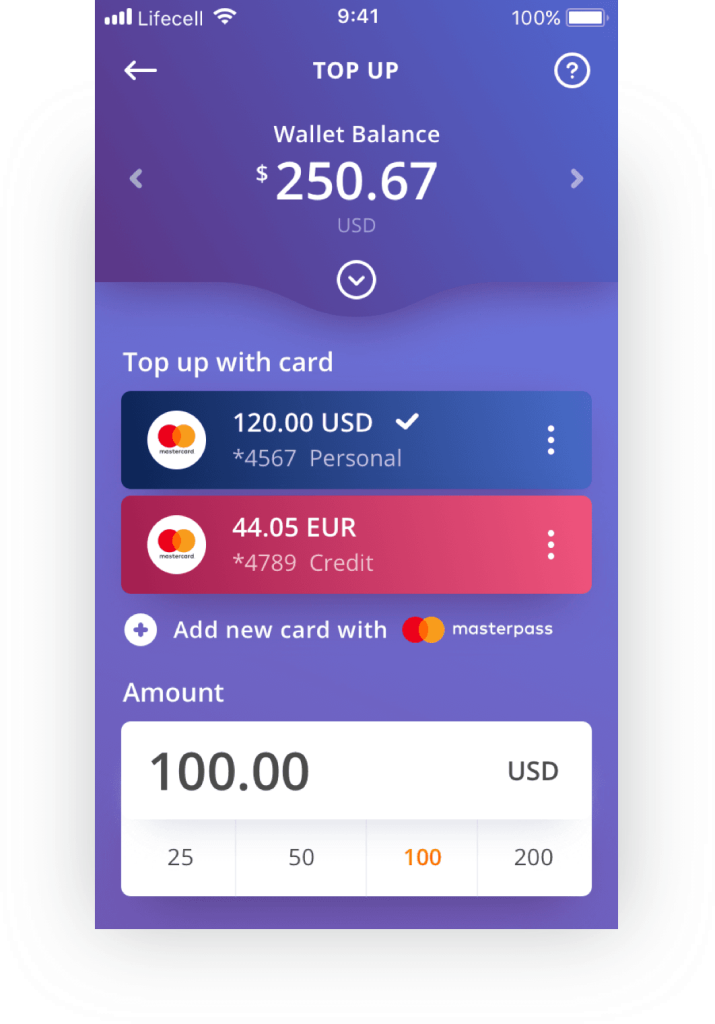

● Credit transaction (Cash-in) – wallet top-up of a specified amount

● Debit transaction (Cash-out) – money withdrawal from the wallet

● Pre-authorization – reservation of funds on the wallet

● Refund – a reversal of a prior debit transaction

Payment tools for eWallet top up and withdrawal

● Cash

● Variety of existing wallets on the particular market

● Credit and Debit Cards: international (Visa and MasterCard) or local (for international cards we may link with MasterPass or Visa Checkout solution or with any PCI DSS compliant partner to store card credentials)

● Banking accounts – we may link directly with particular banks or with any payment gateway

eWallet set up and configuration

● Limits management allows being in line with local legal restrictions (define maximum eWallet balance, monthly turnover etc.)

● Fees and commissions management allow to determine an exact flow of cash from eWallet transactions

● Multicurrency option allows to set up wallets in different currencies

● Exchange rates management allows managing international remittance

Digital wallet app: what is the best digital wallet

Nowadays, a digital wallet or also eWallet can be a fast solution for different retail payment on the special platform. It is possible to use mobile or electronic money, international currency and also use vouchers and prepaid cards. If you wish to create your own business from the very beginning, you can start it with eWallet.

There are 4 types of digital eWallets:

- Wallet of customer – the customer uses this payment tool, which let him make payments;

- Wallet of merchant – users can get money with the help of this payment tool;

- Wallet of agent – it is the tool which can help in converting electronic cash in the cash and vice versa. It is possible to deposit and withdraw money;

- Wallet of issuer – the main purpose is for issuing money

Also, there are such types of transactions:

● Top-up – you can deposit your money, and they will be saved in your wallet;

● Withdrawal – it is possible to take the needed sum of money from your wallet;

● Pre – authorization – it gives you the opportunity to reserve funds on your wallet and prepay;

● Refund – if you make some wrong transactions, it is possible to cancel them and get your money back to the wallet if you purchased something at a store, for example. Because of this fact, you should not worry that you can lose your money. They are in a safe place.

White label application – your own branding

White label helps you change your smartphone into a digitalization tool for making payments. You can get the bills and pay for them at the same moment. It is possible to use QR code for payment for the different services or goods. This white label can transfer money between different users and cards in a matter of few minutes and it will save your time a lot. It has easy authorization and you will not spend a lot of your time on it. The password, which you use when you wish to log in the system, is only for 1 time. It means that security level is high.

Also, it gives you the possibility to have all bonus and discount cards in the same place and you will not need to look for them. If you are the owner of eWallet, you can contact it with any card you have. Just specify the details of your card. You do not have the limits of the cards, all of them can be assigned to the wallet. One user can send money to the another one from your list in mobile phone.

When you scan the code of the needed goods, you will see the price and all needed information about the product. However, this process requires some time (a few minutes) to get all this information.

You can use this wallet for payments in restaurants, shops and cafes.

Digital payment solutions: which suit to you

The main functions of mobile wallet are:

● Online payments;

● Shop payments;

● Payments in different applications;

● Money transfer;

● Bills;

● Tickets;

● Internet

If you wish to deposit or withdraw money, you can use cash. Also, it is possible to use different wallets, which exist on the special market. If you have different debit and credit cards, you can attach them to your wallet and then it is possible to use money. For example, it is possible to use Visa, MasterCard and so on. It gives you more opportunities for different payment operations. If you wish, it is possible to be connected to your bank account.

Also, it is possible to set up limits for your wallet. Also, you can manage all transactions and you can have different currency for your wallet.

If you scan QR code, you do not need to login every time. It is needed just to choose various products and after that you can make the payment. So, as the result you will be able to make your payment in a short time and get the needed result.