Mobile Wallet for Telecom Companies in South Africa

There’s still a lot of people in emerging markets who remain financially excluded, and that’s a known opportunity for Telecom providers searching for new sources of revenue.

With our MFS Enabler enterprise-grade platform, providers gain a field-proven set of tools for telecoms ARPU boosting, increase subscribers’ loyalty, earn more by integrating merchants and financial services and sell more voice and data.The platform makes provision of mobile financial services profitable, simple and easy.

What’s in e-wallet banking for your business?

Effective tool of competition

MFS Enabler platform is based on a processing center for e-money. It’s an integrated framework for both technical support and business development, offering B2B, B2C, and P2P technologies. It comes with a white label smartphone app with QR and NFC features.

Substitution of less profitable platforms

MFS Enabler platform makes possible to seamlessly migrate from obsolete or architecturally limited solutions. Coming with a white label mobile app, it makes possible to integrate any type of payments, ]financial and merchant products and services into a coherent whole, providing toolkit to grow ARPU telecom.

Closer relationships with subscribers

Knowncustomers’ geolocation, web search, etc. can be turned to advantage while managing the client relationship. Our smartphone wallet solution with manageable personalized in-app offerings helps reduce churn and increase brand loyalty. On top of all, MFS users tend to buy more of core voice and data products.

Our team’s extensive financial background helps drive projects’ commercial outcome

With more than 15 years of C-level banking experience prior to fintech, each of us profoundly understands all the streams and chains and roles of all the involved parties. This helps our clients markedly increase MFS market share up to the industry leaders’ level.

Yuriy CHAYKA

Chief Innovations Officer

18 years in banking sector

Mikhail MIROSHNICHENKO

CEO, Co-Founder

18 years in banking (15 years C-level)

Vasiliy CHERNOMOROV

Chief Technical Officer

17 years software business development

Volodymyr BUDANOV

Chief Sales & Marketing

20 years in banking (15 years C-level)

Maximize impact

As mobile financial services imply a lot of revenue streams to get tackled (transactions, services, subscriptions and so forth), our solution provides tools and techniques to finetune each one of them after the implementation.

Lower costs

As a white-label solution with fast deployment rate in just 2–3 months, MFS Enabler narrows down the need for from-scratch development and minimizes cost of maintenance and infrastructure.

Set up new revenue streams

MFS Enabler makes possible for the financial institutions to earn more by connecting merchants and services beyond banking, thus improving users’ loyalty with enriched mobile experience.

What are the mobile wallet benefits for end users?

Online top-up

Make mobile top-up or pay postpaid mobile bills

Loyalty cards

Store all loyalty cards in one place

Utility bill payment

Pay electricity, water or gas bills

Rewards and cashback

Collect and redeem points for in-app activity

Instant money transfer

Send money to Friends and Family membersusing only phone number

Manage money

In-app personal finance management and budget planning

Mobile Payments

Pay to shop or merchant online and offline with Tap & Pay or Wallet QR

Discover more

Enjoy exclusive offers, send gifts, buy tickets, store passes and more

Different payment modes

Choose to pay by direct carrier billing, credit card, bank account or e-money

MFS telecom white label banking use cases

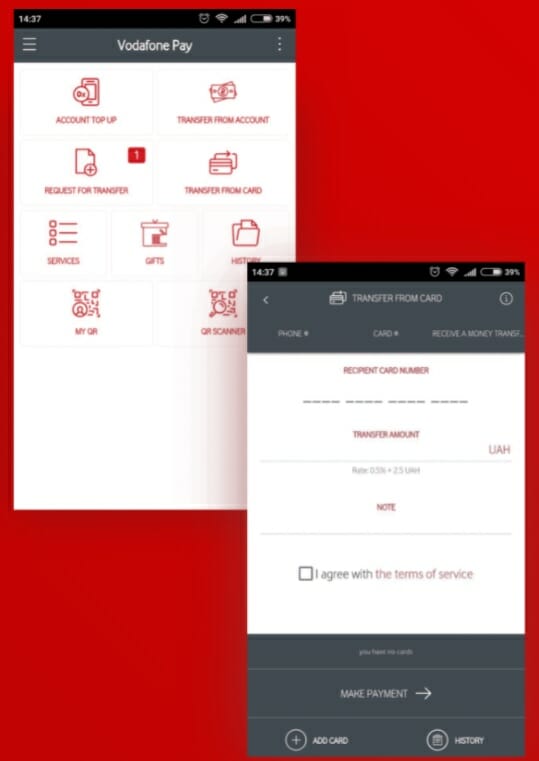

Mobile Wallet for Public Joint-Stock Company «Vodafone Ukraine»

21 million Subscribers

Ukraine Location

Context

Ukrainian market boasts plenty of traditional payment instruments, with growing penetration of mobile usage and payment cards. Yet another telco app development would have little to no effect. So, there was a need for a limited solution for a highly saturated market.

Description

Together with Vodafone Ukraine, we enhanced customers’ financial flexibility with a mobile wallet (Vodafone mobile money \ direct carrier billing + Visa + MasterCard) and added Interoperability function (ability to move money between mobile account and bank accounts and vice versa). To increase active usage and get more attractive for youngsters, Vodafone Pay was reinforced with Mobile gifts functionality.

Mobile wallet for Public Joint-Stock Company «Vodafone Ukraine» is a mobile payment app. Integrated MasterPass solution to turn Mobile Wallet for Public Joint-Stock Company «Vodafone Ukraine» into Credit card payment App and Money transfer App. Money Wallet from Public Joint-Stock Company «Vodafone Ukraine» might be used as a recharge platform, as a payment App, as a tool for mobile financial services.

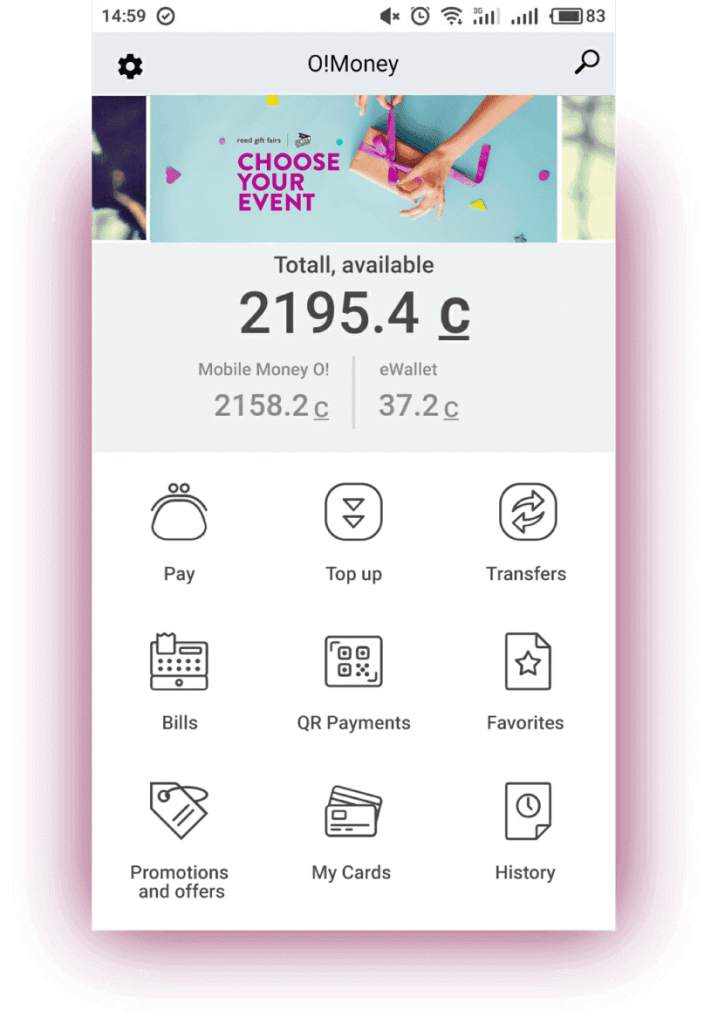

NUR TELECOM

2 million Subscribers

Kyrgyzstan Location

Context

A 3rd telecom provider with a moderate share of subscribers, NUR Telecom pursues flexible yet aggressive policy to grow its customer base. As of early 2017, two bigger competitors have already had their own MFS solutions (mobile money and wallets), so our aim was to introduce the effective tool of competition.

Solution

A competitive product with better offerings management to enable conducting an aggressive base-growing promotion.O! Money” is a mobile payment app with 3 different payment tools inside: Mobile account, eWallet with electronic money and Payment cards (Visa and MasterCard). There are many different options available in the mobile wallet such as P2P transfers, Invoicing, QR code in-Store payments, third party payments. Customers can top up wallet directly from Nur Telecom account or with payment card. Top up with cash is also available in self-service machines.

Contact us and get to know more

● Get in touch to schedule platform demo

● Tell us a few words on your business objectives

● Think of what integrations may be necessary

● Download and test a demo app

● We will outline the optimal cost for your custom solutionh

● Proceed with negotiations with merchants while we do deployment and integration, and then… get appraised for having best mobile wallet app after the launch 🙂

Future telecom solutions to boost ARPU

Mobile Wallet is a modern efficient solution for Telecom companies. mWallet is a payment app designed specifically to make any smartphone a non-cash paying device. It can be utilized as a digital storage as well. It is a comfortable way of making on-line transactions and in-app charges. For people without a bank account it is a perfect means of financial management, which enables them to receive, send and pay money.

Technology is constantly evolving and Telecoms are becoming more flexible in order to enhance customers experience. Among all the emerging alternative ways of communication, digital Wallet makes it possible for Telephone service providers to remain relevant and provides the following benefits:

● Gaining new subscribers;

● Building a strong and mutually beneficial relationship with subscribers;

● Receiving additional revenue due to providing new efficient and competitive services;

● Reducing maintenance expenditures with ready-to-use completely functional application;

● Providing subscribers with immediate and sufficient customer help (prepared FAQ on a separate chapter with easy access for anyone and an opportunity for users to ask any other questions via chat or a hotline, etc.)

White label – best solution to be on top

White label is a product or service produced by someone else, which allows you to purchase it and place your own brand name on it. It gives you the opportunity to acquire works of professional developers and utilize these for your advantage.

It has been proven that White label is a more profitable and convenient answer for businesses, which do not specialize in certain areas. For example, electronic Wallets are used by various agencies, and they can provide basically anything that may require on-line or in-app transactions. Network operators provide communication, while it is developers, who produce operating systems professionally. White label products have a list of clear advantages:

● Receiving a product or a service with guarantee of the best quality due to outsourcing a specific work to a professional team;

● Saving time and money which you can spend on other projects that require your attention;

● Providing an opportunity to expand your own business while focusing on your own job and leaving all the work outside your competence to the experts;

● Offering your clients the best products. Focusing on your objectives and purchasing additional features from other enterprises will ensure providing your customers with better experience.

Main idea of mobile app creating

Digital Wallet is created not only to benefit a business with any resources, but also to satisfy customers’ needs and enhance their experience while using this service. Subscribers can profit from various features included in ewallet, such as:

● Online top-up available anywhere and anytime;

● Instantaneous money transactions;

● Access to exclusive bonuses, limited offers and gifts;

● Various methods of paying, such as credit card, virtual money, etc.;

● Web financial management and planning;

● Cashback and bonus points for utilizing the service.

There are plenty of other benefits for both seller and the customer who chose to subscribe. Modern world is in constant development and requires contemporary resolution. Paying in cash started being replaced by using a more convenient credit card, but now you do not even have to carry it. Having software for global transactions on your smartphone makes working with network telecommunication providers significantly easier. And the same applies to any other purchases in your day-to-day life. The majority of smartphones, especially the ones on Android and iOS, support it. Accessibility and efficiency make this service a necessity for any consumer.